At the start the year, the U.S. economy appeared to be in great shape, having demonstrated significant recovery from the pandemic. Unemployment was down, wages were growing, and the U.S. stock market reached an all-time high on January 3rd. But today, six months later, a whole new set of challenges exist. Inflation has remained persistent and broad based, prompting the Federal Reserve to raise interest rates in the most aggressive manner since 1994. By many measures, the U.S. economy remains strong. Corporate profits, which are at all-time highs, are expected to continue growing, and household finances are in a much stronger position than they were before the pandemic or prior recessions. However, markets are forward looking, and with the Federal Reserve intent on reigning in inflationary pressures, we could see a sharp shift in the economy and market conditions in the coming months. While we acknowledge these risks and will continue to monitor them closely, we believe there are reasons to be optimistic, which we share here in our mid-year outlook.

Economy

With an economy that is roughly two-thirds consumer spending, the strength of the consumer is always top of mind. Unemployment has largely recovered from the pandemic, job openings remain high and wages are up. But to get a gauge of what could be in store in the future, we need to take a deeper look at inflation and its causes. While household finances may be in good shape, persistently high inflation can erode consumers’ purchasing power and corporate profits, thereby altering confidence in the future health of the economy.

Oil & Energy Markets

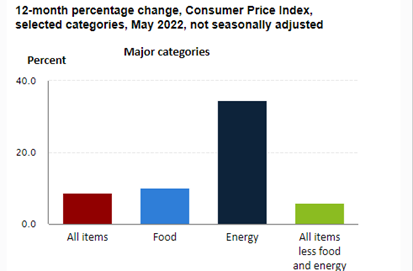

The U.S. is the world’s largest producer and one of the most significant exporters of oil and processed petroleum products. When the government put restrictions in place to prevent the spread of the COVID virus, demand for oil and gas declined, leaving producers without enough space to store their products and temporarily sending oil prices below zero. This disruption to the market’s supply and demand equilibrium, coupled with producers’ hesitation to increase production output due, in part, to the world’s focus on curbing carbon emissions, has resulted in the U.S. losing 1.0 million barrels per day of refining capacity¹. Further, oil supply from Russia, the world’s second-largest producer, has dropped considerably due to economic sanctions imposed on the country following and throughout its invasion of Ukraine, which began in February of this year. As a result, oil and energy prices have risen significantly and have been a big driver of recent inflationary pressures.

Source: U.S. Labor Department

While it does not appear there will be a resolution to the Russia-Ukraine war in the near term, we should keep in mind that the U.S. has more than enough oil supply to meet its domestic demand. Over time, we can expect supply and demand to come more in balance, but the current environment highlights the imbalances that are likely to occur as the world tries to shift to less carbon intensive sources of energy.

Impacts of the Russia-Ukraine War

The impact of the Russia-Ukraine war and resulting economic sanctions on Russia have extended beyond the oil and energy markets to other sectors throughout the world. In addition to a reduction in global oil supplies (and resulting increase in prices), Russia’s positions as the world’s third-largest steel exporter, a significant supplier of fertilizer components, and, along with Ukraine, accounts for 30 percent of the world’s wheat supply, have sent reverberations throughout the global commodity complex. When the shift in commodity prices is viewed in the aggregate, the percentage of discretionary income spent on commodities this year can be compared to the oil shock in the 1970’s.

The Fed

It is not just the energy markets or the Russia-Ukraine war impacting the U.S. economy; inflationary pressures have been broad based. The tight labor market, characterized by higher wages and a shortage of laborers, coupled with rising home and rental prices and hampered supply chains still recovering from the pandemic and lockdowns in China have all contributed. With that in mind, it is important to remember that the Federal Reserve has a dual mandate of full employment and stable prices. Prior to and during the pandemic, when inflation was running well below target, it made sense for Fed officials to prioritize the employment side of the mandate. Today, however, the U.S. has the strongest labor market in decades. This coupled with the challenges highlighted above are forcing the Fed to shift its focus on taming inflation.

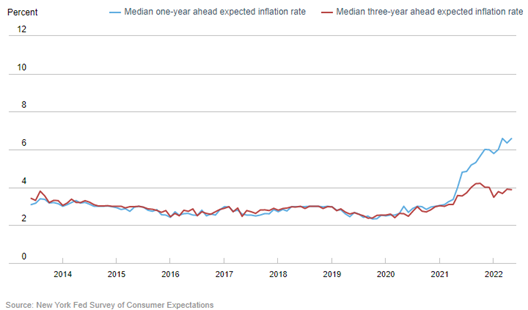

As indicated in the chart below, three-year inflation expectations have started to rise, changing consumer behavior today and ultimately leading to higher inflation down the road. If we expect inflation to be 5 percent, we will make decisions accordingly, causing inflation expectations to become a self-fulfilling prophesy and land at 5 percent. This anchoring of expectations ultimately results in a less efficient allocation of resources.

In short, we do believe the Fed is doing the right thing trying to rein in inflation; the question is how much will this impact economic growth in the coming months?

In short, we do believe the Fed is doing the right thing trying to rein in inflation; the question is how much will this impact economic growth in the coming months?

Technology and the Current Economy

We reviewed several factors that are driving inflationary pressures, and, to draw the closest analogy as to how quickly inflationary pressures have risen and remained persistent, we need to look back to the 1970s. While there are some similarities, today’s economy is far different from then, and we need to keep in mind the deflationary forces technology produces. Navigating these challenges is something we have not done in some time, but the increased efficiency, data collection and analysis that technology provides will eventually allow us to navigate these challenges quicker than we did in the past.

Future Economic Implications

The current economic environment is challenging, and the near-term outlook is uncertain, but we do believe that positive outcomes will prevail. For example, the pandemic and resulting supply-chain issues have highlighted the need and reinvigorated the U.S.’s desire to onshore production. Plans have already been announced to open semiconductor plants in Ohio and Texas, creating a combined 6,000 new U.S. jobs.² Given recent challenges, it is almost certain that other industries will onshore parts production and the supply chain in the future. The removal of Russian oil from the market and the unwillingness of OPEC to shift production highlight the supply and demand imbalances that are likely to continue as economies across the globe work towards lowering carbon emissions. Thankfully, the U.S. has the resources to increase production, and data analytics can allow us to better identify and prepare for imbalances in the future. Finally, the pandemic and ongoing supply-chain issues have illustrated some of the challenges that come with global trade and that likely could result in supply chains taking a more regional focus in the future. While this will likely lead to inflation running somewhat higher than the Fed’s 2 percent target, one could argue that the Fed’s monetary policy could be more effective in such an environment.

Equities

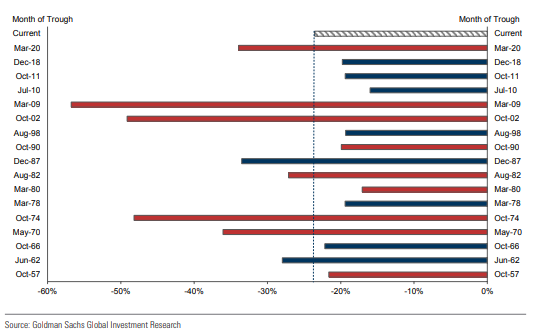

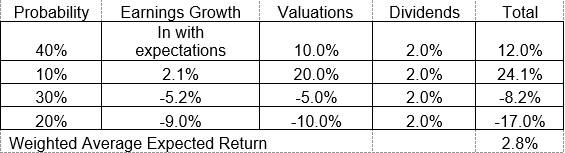

With the S&P 500 in bear market territory, the Fed is attempting to slow inflation by decelerating economic growth. What does this mean for equity markets? One way to answer this is to look at prior market declines. The chart below demonstrates market declines of -15 percent or more going back to 1957, with market declines associated with recessions highlighted in red.  The reason this is significant is that the equity market decline to this point has been entirely evaluation driven, with corporate earnings expected to continue growing unaffected by the recent economic challenges. If we look at earnings during recessions, they have historically declined by 13 percent³. While we believe a recession will likely be avoided, it is an extraordinarily close call, with the probability of a recession increasing in recent weeks. On the bright side, if we look historically, valuations in recessions going back to the 1980s have historically declined by 25 percent. The recent decline in valuations up to this point have already declined in excess of the historical average, suggesting current market levels have priced a good portion of current uncertainties. Further, if we look at recessions that occurred during higher inflationary times, earnings tend to decline less than the historical average, suggesting that if earnings do indeed decline, the magnitude may be less than normal. To try and gauge where the market could be headed, we can break things down into the components of valuations, earnings growth, and dividends.

The reason this is significant is that the equity market decline to this point has been entirely evaluation driven, with corporate earnings expected to continue growing unaffected by the recent economic challenges. If we look at earnings during recessions, they have historically declined by 13 percent³. While we believe a recession will likely be avoided, it is an extraordinarily close call, with the probability of a recession increasing in recent weeks. On the bright side, if we look historically, valuations in recessions going back to the 1980s have historically declined by 25 percent. The recent decline in valuations up to this point have already declined in excess of the historical average, suggesting current market levels have priced a good portion of current uncertainties. Further, if we look at recessions that occurred during higher inflationary times, earnings tend to decline less than the historical average, suggesting that if earnings do indeed decline, the magnitude may be less than normal. To try and gauge where the market could be headed, we can break things down into the components of valuations, earnings growth, and dividends.

Gradual Adjustment

Should inflationary pressure remain despite the Fed’s aggressive rate hikes, we would expect additional interest rate increases later this Fall. Ongoing uncertainties could force businesses and households to be on the defensive, impeding growth and bringing earnings to half the current growth rate. Under this scenario, valuations could decline by 5 percent from their current levels, with dividends continuing at the long-term average of 2 percent, resulting in expected market returns of -8.2 percent.

Fixed Income

Bond yields have risen significantly this year, with 10-year Treasuries more than doubling year to date. This is in stark contrast to what we experienced over the past decades, when bonds produced positive returns before inflation in all but four years since 1976. Going forward, we continue to recommend shorter term bonds given the flatnesss of the yield curve. Longer term bonds do not offer enough additional yield to compensate investors for the greater interest rate risk. We also recommend moving up in credit quality, which will help limit exposure to widening credit spreads and the higher risk of default should economic conditions deteriorate further.

Conclusion

There is a broad range of uncertainties in the current environment, but we believe that many of the current issues we face can be fixed in time. As we stated in previous market outlooks and at the onset of the pandemic, one should not underestimate the United States’ resolve and ability to navigate these challenges. While the Fed’s interest rates hikes will put some pressure on the economy, we believe it is the right decision at this point to sustain longer-term economic expansion. The degree to which the Fed has raised rates will place some uncertainties on both valuations and earnings for equities. Markets are likely to remain choppy in the near term until we have more visibility on whether inflationary pressures are abating and the impact on corporate earnings. In time, however, we expect these challenges to be overcome and for equity markets to continue producing attractive returns. Sources:

1. U.S. Energy Information https://www.eia.gov/ 2. In First Stop on Asia Travel, President Biden Tours Model for Samsung’s New Texas Semiconductor Facility, May 20, 2022. 3. U.S. Equity Views: The Recession Manual for U.S. Equities, Goldman Sach, May 18, 2022 About the Author: Joseph Karl, CFA, is chief investment strategist with Provenance Wealth Advisors (PWA), an Independent Registered Investment Advisor affiliated with Berkowitz Pollack Brant Advisors+ CPAs, and a registered representative with Raymond James Financial Services. For more information, call (954) 712-8888 or email info@provwealth.com. Provenance Wealth Advisors, 515 E. Las Olas Blvd., Ft. Lauderdale, FL 33301 (954) 712-8888. Joseph Karl, CFA, is a registered representative of and offers securities through Raymond James Financial Services, Inc., Member FINRA/SIPC. Raymond James is not affiliated with and does not endorse the opinions or services of Berkowitz Pollack Brant Advisors + CPAs. PWA is not a registered broker/dealer and is independent of Raymond James Financial Services. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc., and Provenance Wealth Advisors. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of the advisors of PWA and not necessarily those of Raymond James. You should discuss any legal or tax matters with the appropriate professionals. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Every investor’s situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Investing involves risk, and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices generally rise. Past performance may not be indicative of future results. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. The above hypothetical examples are for illustration purposes only. Actual results will vary. Future performance cannot be guaranteed, and investment yields will fluctuate with market conditions. Diversification does not ensure a profit or guarantee against a loss. To learn more about Provenance Wealth Advisors financial planning services click here or contact us at info@provwealth.com Posted on July 7, 2022