Planning for Spending During Retirement By Todd A. Moll, CFP®, CFA

One of the primary objectives of financial planning is to ensure that individuals have more than ample spendable cash flow during their retirement years. Navigating the careful balance between spending too much and possibly running out of funds or spending too little and missing out on all the potential joys of retirement is no simple task. This is especially true when considering that retirement planning involves a unique set of uncertain future variables, including a retiree’s future tax rate, risk tolerance, rate of investment return, inflation, unexpected outflows and sequence of returns.

How Sequence of Returns Impacts Retirement Spending

A key determinant of retirement success is the impact of sequence-of-return risk, which can be defined as the threat that a retirement portfolio will experience lower or negative investment returns in the early years of one’s retirement when also withdrawing funds from that portfolio of investments.

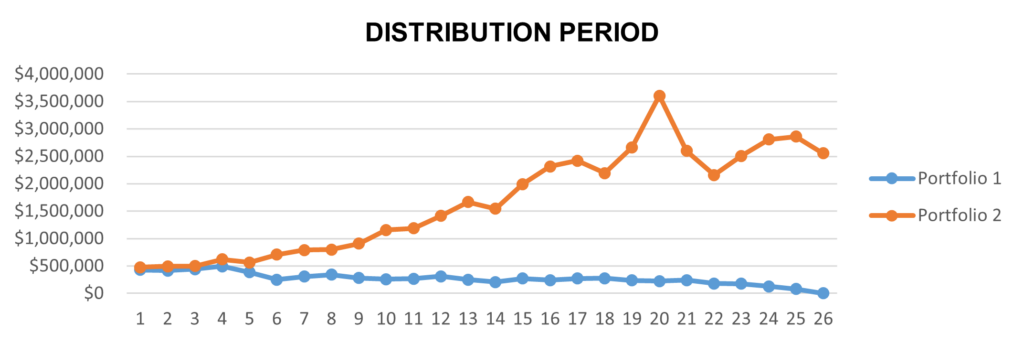

To illustrate this concept, consider a game in which you are dealt six cards, ace through six. During each turn, you must lay down one card without looking at any of those in your hand. The dealer will give you another card if you play an even card. Play an odd card, and the dealer will take a card from you. Depending on the cards you play, you may be out of cards by your third turn, or you may be left with a larger hand to allow you to continue playing for quite some time. As the graph below further demonstrates, when there is a change in the order or sequence of events, investors may receive the same average investment returns, but each retiree will experience drastically different outcomes.

Initial Investment: $500,000

Distribution: $35,000 per year / growing at 3% inflation

Portfolio #1: Annual Compounded Returns of S&P 500 1994-1969 (reverse order)

Portfolio #2: Annual Compounded Returns on S&P 500 1969-1994

This is a hypothetical illustration and is not intended to reflect the actual performance of any particular security. Actual investor results will vary.

Risk Tolerance and Allocation

As is often the case, an investor’s risk tolerance tends to decline at or during retirement. However, risk may mean different things, both emotionally and financially, to different people. For some, the risk may translate to losing money or experiencing market fluctuations. For others, risk may mean having inflation eat away at their purchasing power, outliving their money, or even spending too little during retirement. It is important to consider that when an investor reduces one risk (i.e., market risk), they are likely to increase another (i.e., inflation risk). Reviewing these factors can help investors frame what is important to them and may be used as a guide to help them develop an appropriate investment allocation that meets their risk tolerance.

How Much Can I Spend in Retirement without Running out of Money?

In general, a person planning for a 10-year retirement can potentially spend a lot more as a percent of their portfolio than someone preparing for a 30-year retirement. However, how much an individual can spend in retirement will depend on many factors, including their longevity, tax rates, health care costs, desires to make gifts and bequests, and much more.

Countless studies suggest that a 3 to 4 percent annual withdrawal rate from investment assets can provide the average retiree with a reasonably high chance of successfully maintaining assets throughout a 25-year retirement[1]. However, for the past 15 years, interest rates have been at extremely low levels, making a blended return more dependent on stock market performance and increased risk. The current environment of higher rates may be a window to generate a return from fixed-income investments that have not existed for over a decade. The trade-off to this is the potential for prolonged inflation.

A Better Approach

In the current economic environment, investors should consider the following points to achieve retirement success. Each will likely add incrementally towards increasing investors’ chances of achieving their ultimate retirement savings and spending goals.

- Identify your fixed and variable expenses. Many expenses, including a mortgage, are fixed and do not inflate annually. Therefore, they may have less impact on your future cash needs. In addition, by noting truly discretionary expenses, you can prioritize items that you may want to eliminate in a financial downturn to potentially reduce the impact of sequence-of-returns risk. Moreover, identifying your fixed expenses can allow you to establish a plan to cover those costs each year, irrespective of market returns.

- Prioritize your goals. Will you be willing to forego giving your children an inheritance, if need be, or would you rather spend less? Should you sell the vacation home or drop the country club membership? While retirement planning aims to avoid these choices, you may need to make these tough decisions. A forthright discussion with your spouse is essential to ensure both of you are on the same page.

- Use the 3 to 4 percent withdrawal rule as merely the starting point for a spending plan. Time horizon, risk tolerance and inheritance objectives will influence the amount a retiree should withdraw as a percentage of their investment portfolio. For example, individuals retiring before age 65 may be better served when they rely on a 2 to 3 percent withdrawal rate. This may help position investors to get a few “raises” in the future if returns are better than projected.

- Review your comfort level with the variables. If you want to aim for a 99 percent chance of success, you may need to become comfortable with a lower withdrawal rate. If you’re going to spend more money before or during your first years of retirement, you might have to be willing to accept more uncertainty later in retirement.

- Review the impact that changes to your spending schedule will have on your net worth. Can you increase withdrawals if your portfolio goes up? If yes, by how much? How much should you reduce expenses in a downturn? Is the portfolio allocation still applicable?

- Have a plan. A well-crafted and integrated estate, retirement and investment plan can add significantly towards achieving your goals. By example, a thoughtful estate plan can help increase the net result to your heirs, allowing you to spend more on yourselves during retirement.

- Review your progress. To improve your retirement experience and potentially reduce the chance of unwelcome surprises, consider working with experienced and nimble financial advisors who have the knowledge and resources required to regularly review your plan, evaluate your changes in circumstances, and make the correct course, as needed.

Retirement planning is a dynamic process that requires both financial and emotional evaluation and decision-making. A successful retirement is never a singular event, but rather a series of decisions made throughout your lifetime; decisions for which the team at Provenance Wealth Advisors is well-equipped to assist you and your family.

About the author: Todd A. Moll, CFP®, CFA, is a director and chief investment officer with Provenance Wealth Advisor (PWA), an Independent Registered Investment Advisor affiliated with Berkowitz Pollack Brant Advisors + CPAs and a registered representative with PWA Securities, LLC. He can be reached at the firm’s Fort Lauderdale, Fla., office at (954) 712-8888 or info@provwealth.com.

Provenance Wealth Advisors (PWA), 200 E. Las Olas Blvd., 19th Floor, Ft. Lauderdale, FL 33301 (954) 712-8888.

Todd A. Moll, CFP®, CFA, is a registered representative of and offers securities through PWA Securities, LLC, Member FINRA/SIPC.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct.

Any opinions are those of the advisors of PWA and not necessarily those of PWA Securities, LLC. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of PWAS, we are not qualified to render advice on tax or legal matters. You should discuss any tax or legal matters with the appropriate professional. Prior to making any investment decision, please consult with your financial advisor about your individual situation.

Every investor’s situation is unique. You should consider your investment goals, risk tolerance and time horizon before making any investment or withdrawal decision. Investing involves risk and you may incur a profit or loss regardless of the strategy selected.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. Stock market. Direct investment in any index is not possible. Although certain investment products are designed to provide investment results that generally correspond to the price and yield performance of their respective underlying indexes, these products may not be able to exactly replicate the performance of the indexes due to expenses and other factors. Asset allocation and diversification do not ensure a profit or guarantee against loss.

[1] Bergen, William P. 1994 “Determining withdrawal rates using historical data”, Journal of Financial Planning

To learn more about Provenance Wealth Advisors financial planning services click here or contact us at info@provwealth.com

Updated February 5, 2024

← Previous